Will I get a 1099?

In accordance with United States tax laws, L&E Research is required to send Tax Form 1099 to anyone who has been sent a combined total of $600 (or more) in paid honorarium remuneration within a calendar year.

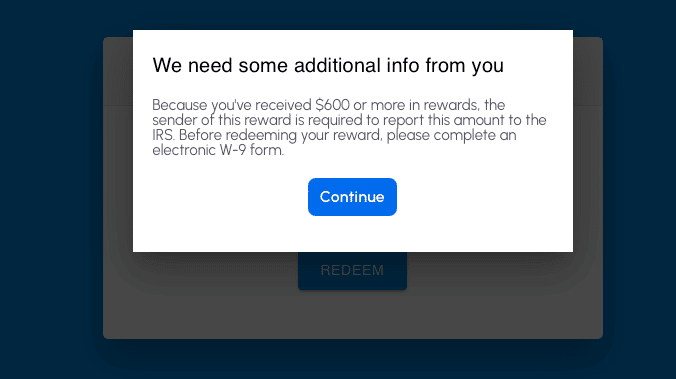

To ensure compliance with United States tax laws, We will require a completed W-9 form as soon as a respondent is paid $600 within a calendar year. Once you reach this threshold, you should see a W-9 pop up, if claiming via Tremendous, before it will give you your honoraria/remuneration. L&E Research may also send the W-9 request directly to you to complete.

If you were not paid $600 or more within the calendar year, you will NOT receive a 1099 and therefore would not need to claim the L&E Research remuneration on your taxes.

Beginning in October 2022, When claiming your gift cards through our Incentive Company Tremendous, you will automatically see a W-9 window pop up when applicable. All you need to do is complete the form, and you will be able to collect your gift card after completing.

Please note any information you enter into the Tremendous site is encrypted and secured and is not shared with any 3rd party companies. This is strictly to ensure we are in compliance with IRS guidelines.

**Prior to October 2022, if you exceed the $600 incentives, you’ll receive an email from Tax1099.com on behalf of L&E Research to complete.

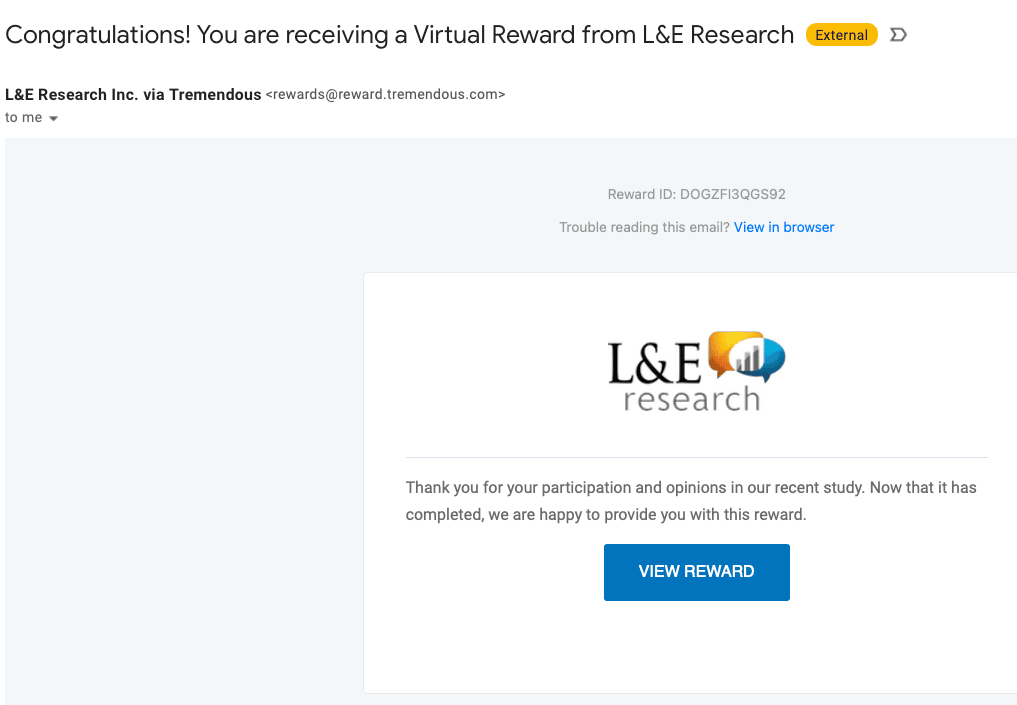

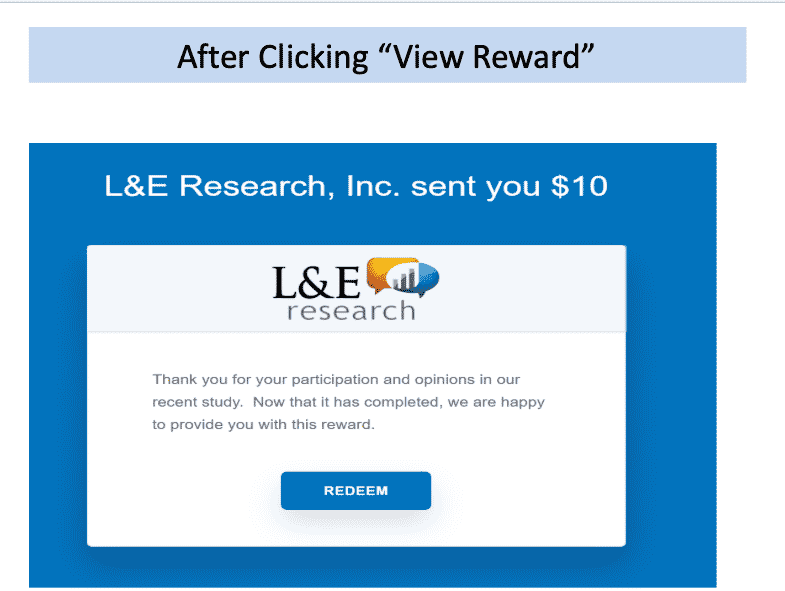

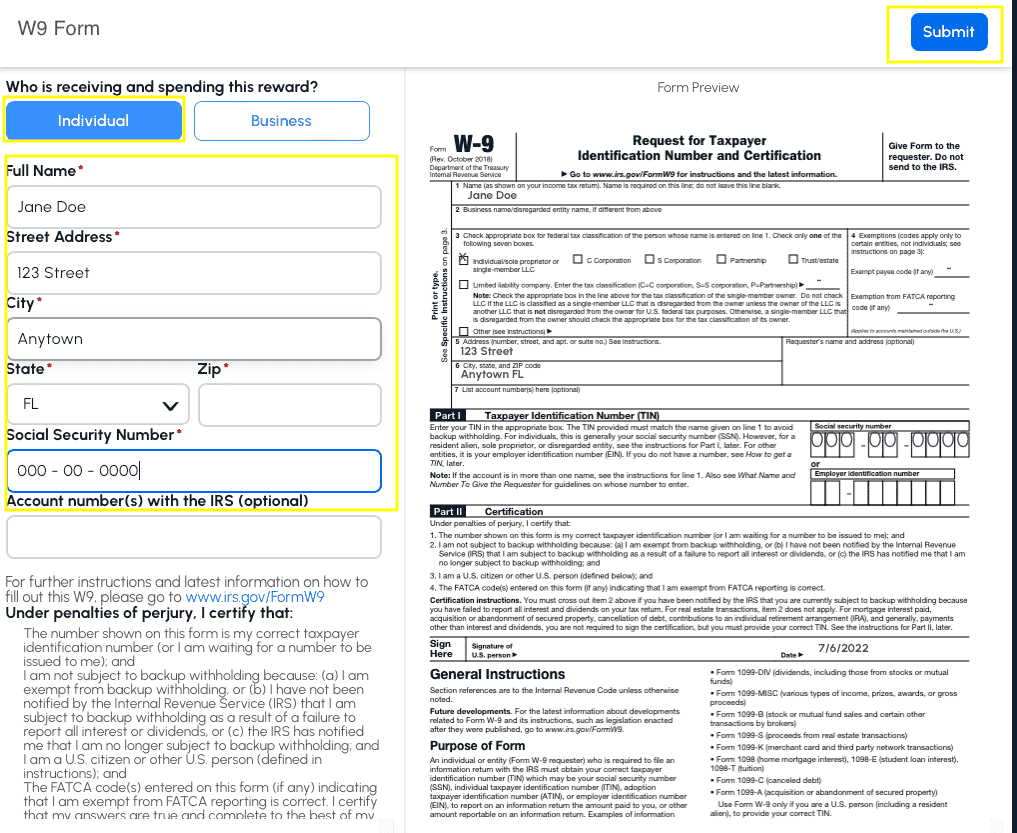

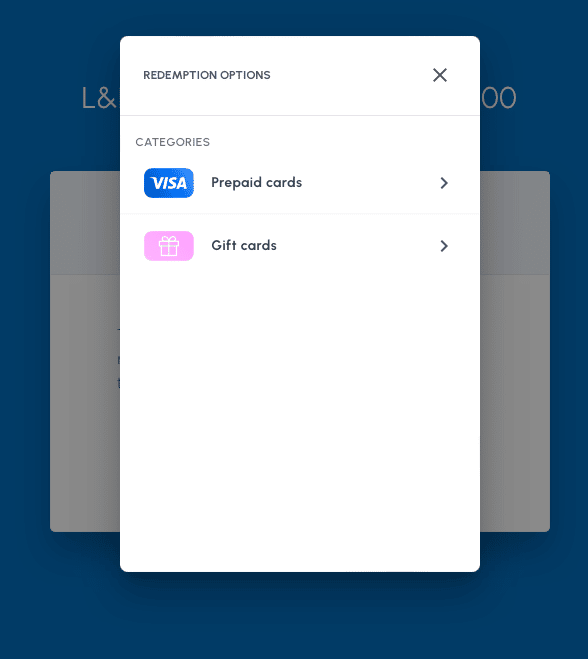

Please see below for an example of the screens you’ll receive:

2. You will receive this screen if you’ve exceeded $600 in incentive payouts:

3. The W-9 form auto opens, you’ll submit your information online, auto sign below and click submit:

4. Once you submit your W-9, you’ll then receive the regular screen to choose your payment option as normal. You will not be allowed to proceed to this screen to receive your incentive until you’ve submitted your online W9 form.

For issues, please contact:

Need a visual? Watch this video explaining how it works: